This feature saves you the time and effort of manually uploading documents. Shortly after you sign up, we’ll give you a call to learn more about your business and bookkeeping needs. On this call, we’ll connect your accounts to Bench, and gather any extra documentation we need to complete your books. bookkeeping for real estate investors Our team takes the time to deeply understand your business, answer your questions, help you link your accounts, and show you how Bench works. Get your bookkeeping, income tax prep, and filing done by experts—backed by one powerful platform.From startups to agencies, Bench works with New York City small businesses.

- According to IRS Topic No. 414 Rental Income and Expenses, most real estate investors operate on cash basis accounting.

- Real estate bookkeeping plays a pivotal role in aiding real estate investors in making informed decisions.

- Prepare for these scenarios in advance to minimize disruptions and protect all parties.

- Recognizing these patterns can inform decisions, whether it’s about adjusting rent for a rental property or initiating capital improvements.

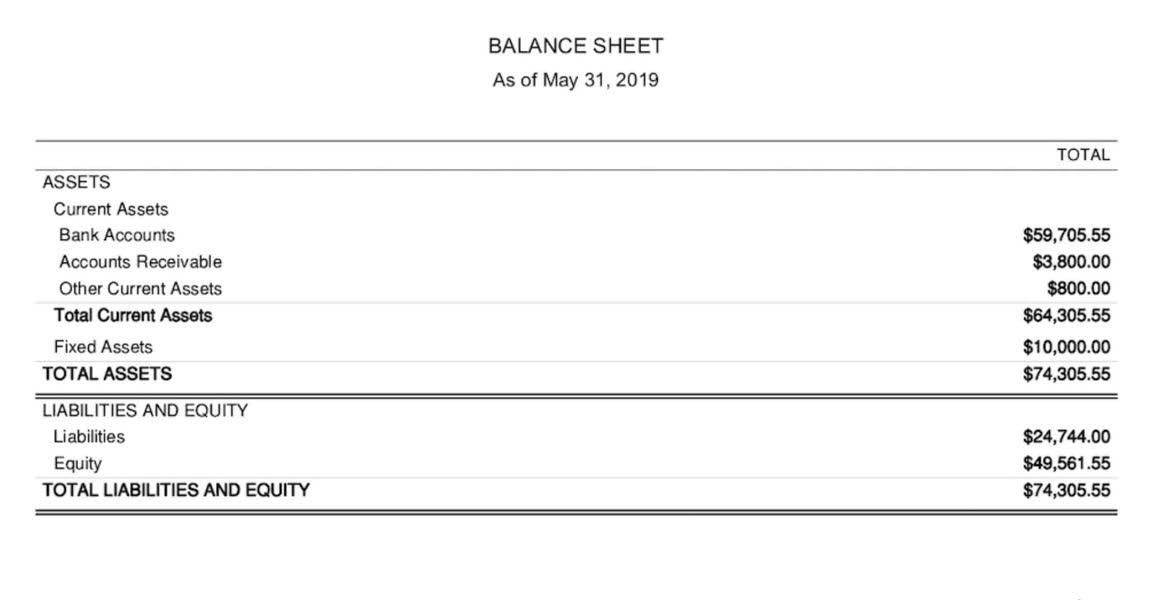

- Real estate bookkeeping provides a clear and concise view of the cash flow of a real estate business.

Key Principles of Real Estate Tax Accounting: What You Need to Know

Each party should have a clear scope of work and joint venture agreement obligations. Whether the company adopts a cost model or a fair value model as an investment company (Tip. 9467) or operates under industry-specific accounting advice will determine the implications of this basic difference. Property managers must track and reconcile security deposits accurately and efficiently to avoid legal issues, maintain good relationships, and protect clients. Amortisation is the gradual repayment of a mortgage or loan through scheduled payments that cover both the principal amount and interest. The lender computes the amortisation schedule when you borrow money to buy a property, detailing the repayment plan.

- With a clear and organized bookkeeping system, preparing for tax time becomes less daunting and more systematic.

- Pramod has over 11 years of experience relating to finance and accounts in diversified industries.

- There are some times that we’ll request documents from you (like account statements or receipts), just to ensure the information we have is correct.

- The integration of accounting software and property management software has further elevated the role of bookkeeping in the industry.

- The dynamic world of real estate taxation demands businesses stay updated.

Simple, straightforward pricing for everything your business needs.

While it’s possible, the complexities of real estate accounting often mean that without professional guidance, costly mistakes can arise. Hiring https://www.facebook.com/BooksTimeInc/ an expert or consultant, even periodically, can be a wise investment. A meticulous bookkeeping process ensures that all potential deductions, from capital expenses to routine repairs, are recorded and accounted for.

Disposal property

This report can be generated monthly, quarterly, and annually, and will very clearly display the profitability or depreciation of your business. Although this seems like a no-brainer, you’d be surprised at how many errors can occur between your book and your bank account. The process of matching your books to your bank account is called bank reconciliation. Making sure your receipts match the amount debited from your account is imperative. Mistakes happen, and companies can overcharge you, or even charge you twice! This can occur more often than you think and can help your business save a lot of money by catching errors.

Strategies for Tracking Rental Income and Expenses Effectively

- While accounting is probably one of the least favorite tasks that most investors want to do, good accounting can help keep property profits higher by accurately tracking income, expenses, and tax deductions.

- If you were questioning if real estate professionals really need a bookkeeper, sure enough, the answer at this point would be a “yes!

- Property owners must consider these payments as income upon receipt, regardless of the chosen accounting method.

- By analyzing past financial data, businesses can set budgets for advertising, repairs, and other expenses, ensuring profitability in future ventures.

- In other words, the IRS understands that real estate investors will have to spend money to keep their properties up to standards and to fight against deprecation.

Real estate bookkeeping plays a pivotal role in aiding real estate investors in making informed decisions. The bookkeeping process systematically organizes the inflow and outflow of funds, giving a clear picture of the profitability of a rental property or any real estate business venture. This clarity, reflected in monthly financial statements, aids in evaluating investment performance and planning future strategies.

- Understanding the division between bookkeeping and accounting gives you more confidence and helps you know when to delegate tasks to other professionals in these crucial areas.

- Perhaps the most important thing to track, however, are your goals for the future.

- A strong foundation in accounting best practices paves a smooth path for your business to flourish and win new clients.

- Moreover, utilizing property management software or accounting software that is compatible with your bank account can assist in categorizing, reconciling, and reporting your reserve fund activities.

- One of the cornerstones of accurate bookkeeping is the regular reconciliation of records with bank and credit card statements.

- Larger expenses include office rentals, event space, and recurring services such as cleaning or maintenance.

Although the task is the same, who it is being done for makes all of the difference, and that especially applies when it comes to bookkeeping for real estate agents and real estate investors. The https://www.bookstime.com/ way it’s done can differ due to the nature of their roles and the types of transactions they engage in. The real estate industry is subject to a myriad of regulations and tax laws that can be complex and ever-changing.