Choosing among weighted average cost, FIFO, or LIFO can have a significant impact on a business’ balance sheet and income statement. Businesses would select any method based on the nature of the business, the industry in which the business is operating, and market conditions. Inventory costing remains a critical component in managing a business’ finances.

Weighted Average

As a result, LIFO isn’t practical for many companies that sell perishable goods and doesn’t accurately reflect the logical production process of using the oldest inventory first. Do you routinely analyze your companies, but don’t look at how they account for their inventory? Explore the financial and tax impacts of FIFO vs. LIFO inventory methods and their implications on your business.

Conversion of Reported Financial Statements from LIFO to FIFO

Because the expenses are usually lower under the FIFO method, net income is higher, resulting in a potentially higher tax liability. As a result, LIFO doesn’t provide an accurate or up-to-date value of inventory because the valuation is much lower than inventory items at today’s prices. Conversely, if inflation is negative, the impact of LIFO and FIFO will be reversed as described above. FIFO assumes that cheaper items are sold first, generating a higher profit than LIFO.

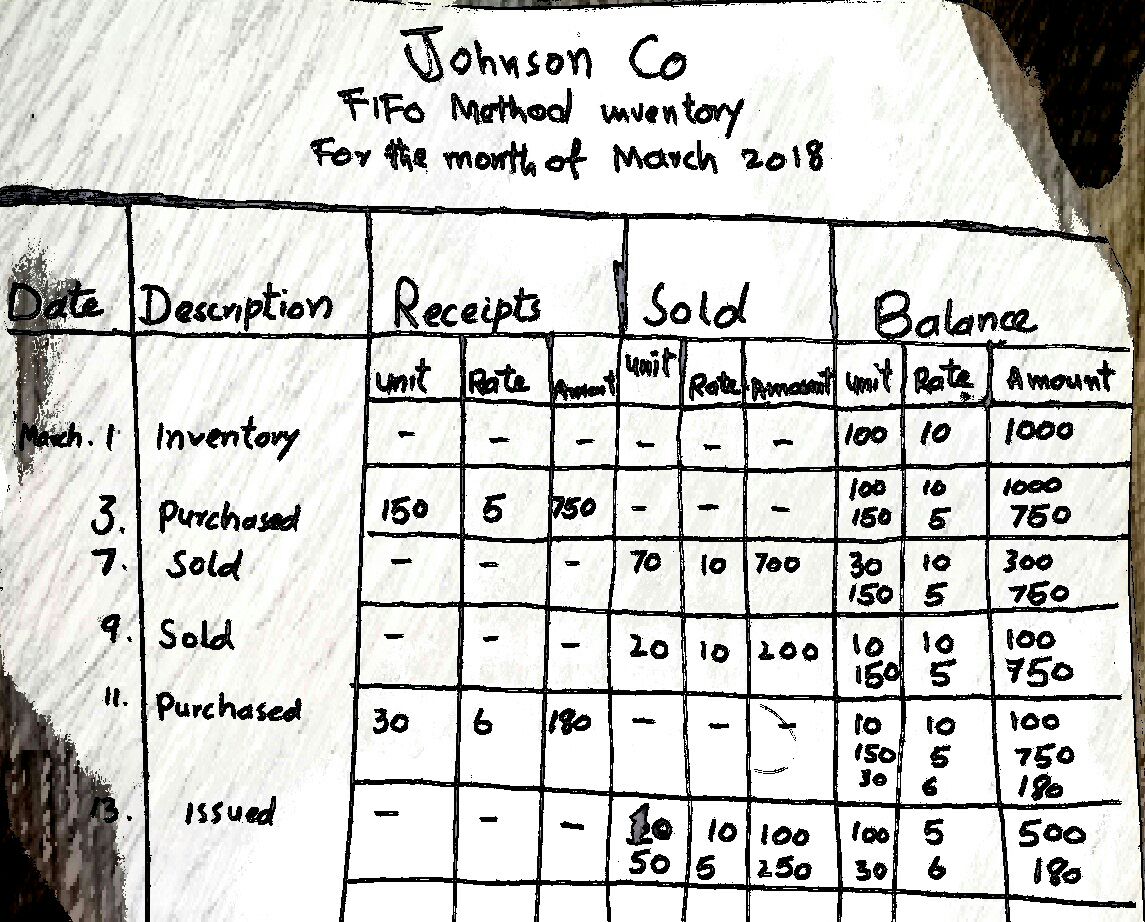

FIFO vs. LIFO Inventory Valuation

Keep your accounting simple by using the FIFO method of accounting, and discuss your company’s regulatory and tax issues with a CPA. LIFO, conversely, can offer substantial tax advantages, particularly in an inflationary environment. By matching the most recent, higher costs of inventory against current revenues, LIFO increases the cost of goods sold, thereby reducing taxable income. This reduction in taxable income can lead to significant tax savings, freeing up cash flow that can be reinvested into the business or used to pay down debt. However, it’s important to note that these tax benefits come with trade-offs, such as potentially lower reported earnings, which might not be as appealing to investors.

FIFO accounting results

Suppose the batch numbers are in order of date of production of the batches. LIFO stands for Last In, First Out, which implies that the inventory added last to the stock will be removed from the stock first. So the inventory will leave the stock in an order reverse of that in which it was added to the stock. Compute the ending inventory for Dino Radja Company for 2014 through 2019 using the dollar-value LIFO method. Additional data regarding Elsa’s sales of Xpert snowboards are provided below.

- Although the ABC Company example above is fairly straightforward, the subject of inventory and whether to use LIFO, FIFO, or average cost can be complex.

- However, the lower net income can be advantageous for tax purposes, as it reduces the taxable income.

- The profit (taxable income) is $6,900, regardless of when inventory items are considered to be sold during a particular month.

- Businesses would use the LIFO method to help them better match their current costs with their revenue.

- Since the remaining inventory is valued at more recent, higher costs, the total assets of the company appear more substantial.

As a result, the 2021 profit on shirt sales will be different, along with the income tax liability. Again, these are short-term differences that are eliminated when all of the shirts are sold. The LIFO method requires advanced accounting software and is more difficult to track. You’ll spend less time on inventory accounting, and your financial statements will be easier to produce and understand.

Smart Watch Company reported the following income statement data for a 2-year period. The difference between FIFO and LIFO will exist only if the unit costs of a company’s products are increasing or decreasing. The inventory amount will have to be adjusted by adding annual recurring revenue arr formula calculator the disclosed LIFO reserve to the inventory balance that is reported on the balance sheet. While the weighted average method is a generally accepted accounting principle, this system doesn’t have the sophistication needed to track FIFO and LIFO inventories.

For this reason, companies must be especially mindful of the bookkeeping under the LIFO method as once early inventory is booked, it may remain on the books untouched for long periods of time. Do you routinely analyze your companies, but don’t look at how they account for their inventory? For many companies, inventory represents a large, if not the largest, portion of their assets.

The cost of goods sold computations for Sooner company and Later Company are shown as below Instructions Compute inventory turnover and days in inventory for each company. Instructions Compute the cost of ending inventory and the cost of goods sold under (1) FIFO and (2) LIFO. Elsa’s Boards sells a snowboard, Xpert, that is popular with snowboard enthusiasts, Information relating to Elsa’s purchases of Xpert snowboards during September is shown below. It uses a perpetual inventory system During July, the company had the following purchases and sales. You are provided with the following information for Koetteritz Inc. for the month ended June 30, 2019.

However, in the real world, prices tend to rise over the long term, which means that the choice of accounting method can affect the inventory valuation and profitability for the period. Navigating the complexities of inventory accounting becomes even more intricate when considering international accounting standards. The International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP) in the United States have different stances on inventory valuation methods. While GAAP permits both FIFO and LIFO, IFRS only allows FIFO and the weighted average cost method, explicitly prohibiting LIFO. This divergence can create challenges for multinational companies that operate in jurisdictions adhering to different accounting standards. By using the cost of the most recently acquired inventory to calculate COGS, LIFO can result in higher COGS during inflationary periods.

Charapata Company applied FIFO to its inventory and got the following results for its ending inventory. Cameras100 units at a cost per unit of $65 Blu-ray players150 units at a… Rayre Books uses the retail inventory method to estimate its monthly ending inventories. The following information is available for two of its departments of October 31, 2019. The accounting records showed the following gross profit data for November and December.