Its intuitive design and powerful computational abilities allow you to easily input data, perform calculations, and analyze results effectively. Sourcetable is particularly effective for experimenting with various hypothetical scenarios using AI-generated data, providing deeper insights into your overhead costs. Regular calculation and analysis of the plantwide overhead rate can serve as a barometer for a company’s financial health, revealing inefficiencies and helping maintain economic stability. Yes, the plantwide overhead rate is also known as the predetermined overhead rate. Understanding and applying the plantwide overhead rate aids in strategic decision-making.

Formula

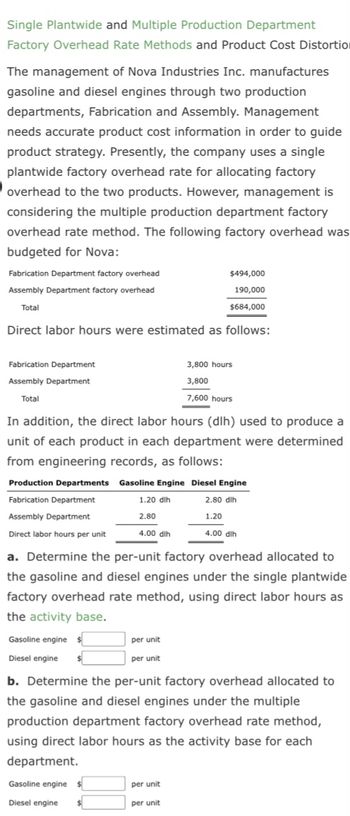

In that case, we might choose to allocate fixed overhead based on direct labor hours (DLH) or direct labor dollars (DL$). If our standard direct labor cost is the same for both purses, these two calculations will produce the same results, so in this lesson, we’ll use DL$. However, if workers producing deluxe purses are more highly paid than workers producing basic purses, the outcome between the two direct labor methods would be different. The choice of an allocation method depends on how managersdecide to group overhead costs and the desired accuracy of productcost information. For example, HewlettPackard’s printer production division may choose tocollect all factory overhead costs in one cost pool and allocatethose costs from the cost pool to each product using onepredetermined overhead rate.

Managerial Accounting

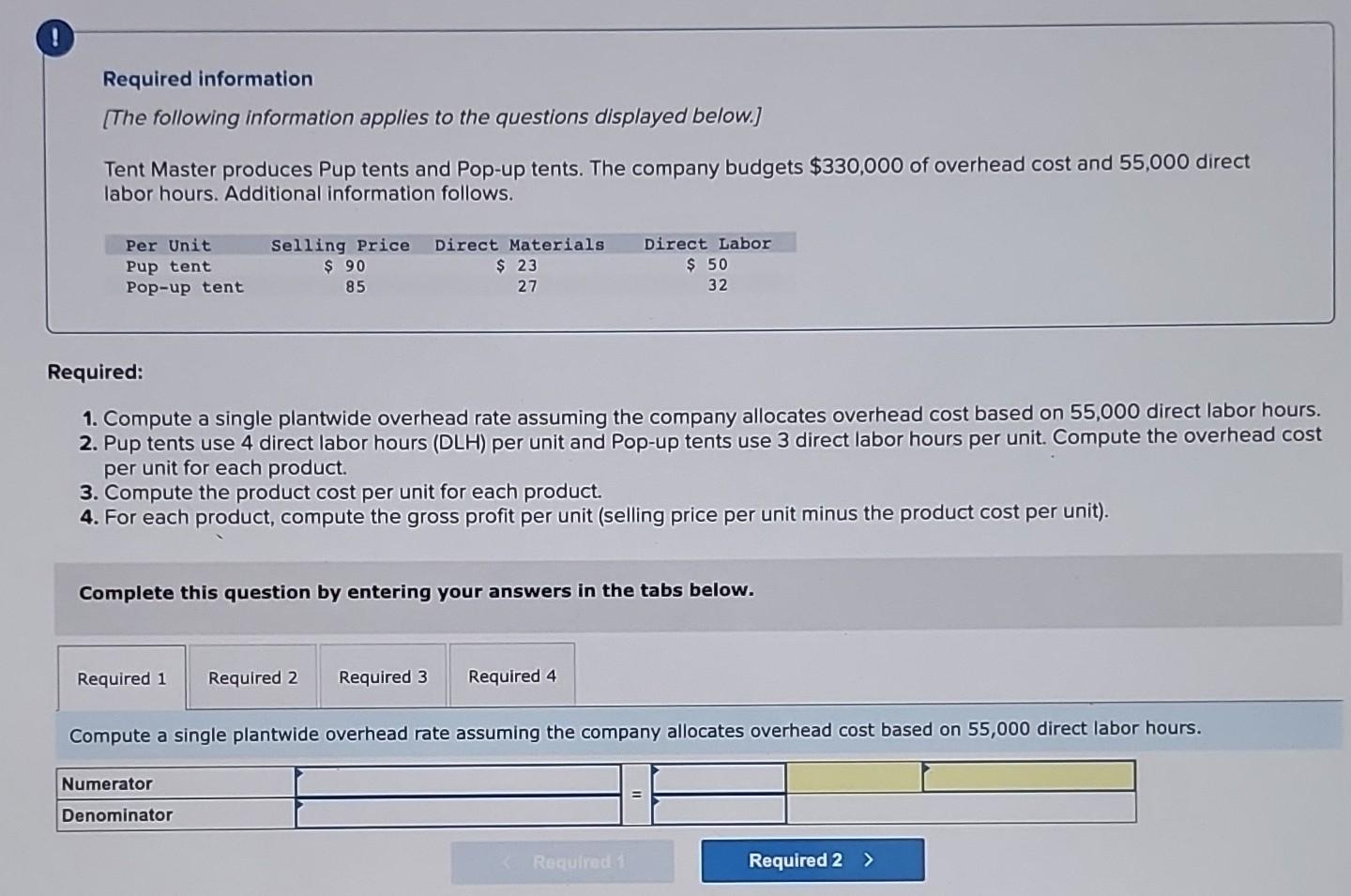

Understanding and calculating the plantwide overhead rate is crucial for businesses aiming to assign manufacturing overhead costs precisely across all units. This calculation aids in determining the cost per unit, aiding in pricing and cost control measures effectively. It involves dividing the total factory overheads by the total number of units produced or the total hours of labor, offering a simpler allocation base compared to departmental overhead rates. Knowing how to calculate the plantwide overhead rate can help optimize production costs and enhance financial accuracy.

- Understanding and calculating the plantwide overhead rate is crucial for businesses aiming to assign manufacturing overhead costs precisely across all units.

- We’ll study how this works in the next section, but first check your understanding of using a single rate to allocate fixed manufacturing overhead to products.

- Management maynot want more accurate product cost information or may not have theresources to implement a more complex accounting system.

- Once we have determined our allocation rate, we apply that rate to each product or product line in order to assign costs to individual items or batches.

- The Cut andPolish department expects to use 25,000 machine hours, and theQuality Control department plans to utilize 50,000 hours of directlabor time for the year.

Simplify Any Calculation With Sourcetable

The department allocation approach allows cost pools to beformed for each department and provides for flexibility in theselection of an allocation base. Although Figure 3.3 shows just tworates, many companies have more than two departments and thereforemore than two rates. Organizations that use this approach tend tohave simple operations within each department but differentactivities across departments. One department may use machinery,while another department may use labor, as is the case withSailRite’s two departments.

This approach allows for the use of differentallocation bases for different departments depending on what drivesoverhead costs for each department. For example, the HullFabrication department at SailRite Company may find that overheadcosts are driven more by the use of machinery than by labor, andtherefore decides to use machine hours as the allocation base. TheAssembly department may find that overhead costs are driven more bylabor activity than by machine use and therefore decides to uselabor hours or labor costs as the allocation base. One more approach is to calculate the plantwide overhead rate using an alternative approach or direct cost method. To calculate this, we first need to identify the total direct cost of production and the total overhead cost for the specific period. Thus, this total overhead is divided by the total direct cost to ascertain the single plantwide overhead rate.

Choose Sourcetable for its powerful AI capabilities, ease of use, and unmatched accuracy in financial and mathematical computations. Unlock the full potential of data processing using Sourcetable, a cutting-edge AI-powered spreadsheet designed to simplify complex calculations. Whether you’re a student, professional, or enthusiast, Sourcetable provides an intuitive platform for all your computational needs. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

Management maynot want more accurate product cost information or may not have theresources to implement a more complex accounting system. As we moveon to more complex costing systems, remember that these systems aremore expensive to implement. Thus the benefits of having improvedcost information must outweigh the costs of obtaining theinformation.

This section provides practical examples to illustrate the computation process. To efficiently calculate the plantwide overhead rate, understanding the components and steps involved is crucial. This rate helps allocate manufacturing overheads to each unit produced, simplifying cost analysis and pricing strategies. Yes, the plantwide overhead rate can also be calculated using direct cost, by dividing the total overhead cost by the total direct cost for a period. A plant-wide overhead rate is often a single rate per hour or a percentage of some cost that is used to allocate or assign a company’s manufacturing overhead costs to the goods produced.

As the name implies, these overhead rates take into account the entire plant and not a particular segment or department. The plantwide overhead rate might not help obtain exact figures, but the estimates are efficient enough for better planning. Notice that under this allocation method, using direct machine hours instead of units, we have a dramatically different outcome. Under this allocation method, it looks like the deluxe purse is actually losing money. The calculation of a product’s cost involves threecomponents—direct materials, direct labor, and manufacturingoverhead.

Nimble Corporation uses 10,000 direct labor hours in its main production facility in a typical month. Since the factory has a relatively simple production process, the controller decides to implement a plantwide overhead rate that is allocated based on the number of direct labor hours. Based on the preceding information, the plantwide overhead rate is $80 per direct labor hour. The plantwide overhead rate is a single overhead rate that a company uses to allocate all of its manufacturing overhead costs to products or cost objects. This is a simplified approach to cost allocation that works well in smaller and simpler businesses.

In companies across sectors such as manufacturing and service, the use of a plantwide overhead rate simplifies the allocation of indirect costs, reducing complexity and saving time compared to multiple allocation methods. The manufacturing plant requires 1000 labor hours to manufacture 500 units of a specific product, which we assume as product X. The same manufacturing plant also produces 1000 units of another product, which we call product Y, using 500 labor hours. Kline Company the main advantage of the plantwide overhead rate method is: expects to incur $800,000 inoverhead costs this coming year—$200,000 in the Cut and Polishdepartment and $600,000 in the Quality Control department. The Cut andPolish department expects to use 25,000 machine hours, and theQuality Control department plans to utilize 50,000 hours of directlabor time for the year. Small businesses benefit from using a plantwide overhead rate for product costing, especially when they have a simple, uniform cost structure or a single product line.